Annual depreciation tax shield calculator

As such the shield is 8000000 x 10 x 35 280000. Depreciation or CCA tax shield depreciation or CCA amount x marginal tax rate 75000 x 35 26250 7.

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

In short the Net Present Value of the Depreciation Tax Shield is 5 lower with the Sum-of-Years-Digits approach.

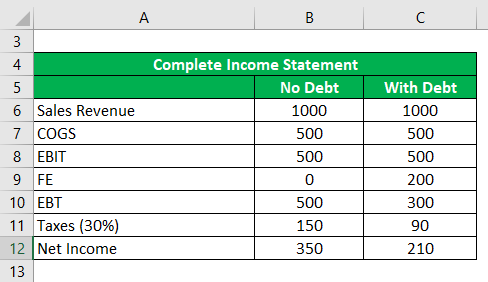

. For instance if the tax. Since the interest expense on debt is tax-deductible it makes debt funding that much cheaper. For Scenario A the depreciation expense is set to be zero whereas the annual depreciation is assumed to be 2 million under Scenario B.

For example suppose you can depreciate the 30000. Multiply your tax rate by the deductible expense to calculate the size of your tax shield. Using it is quite simple you are only.

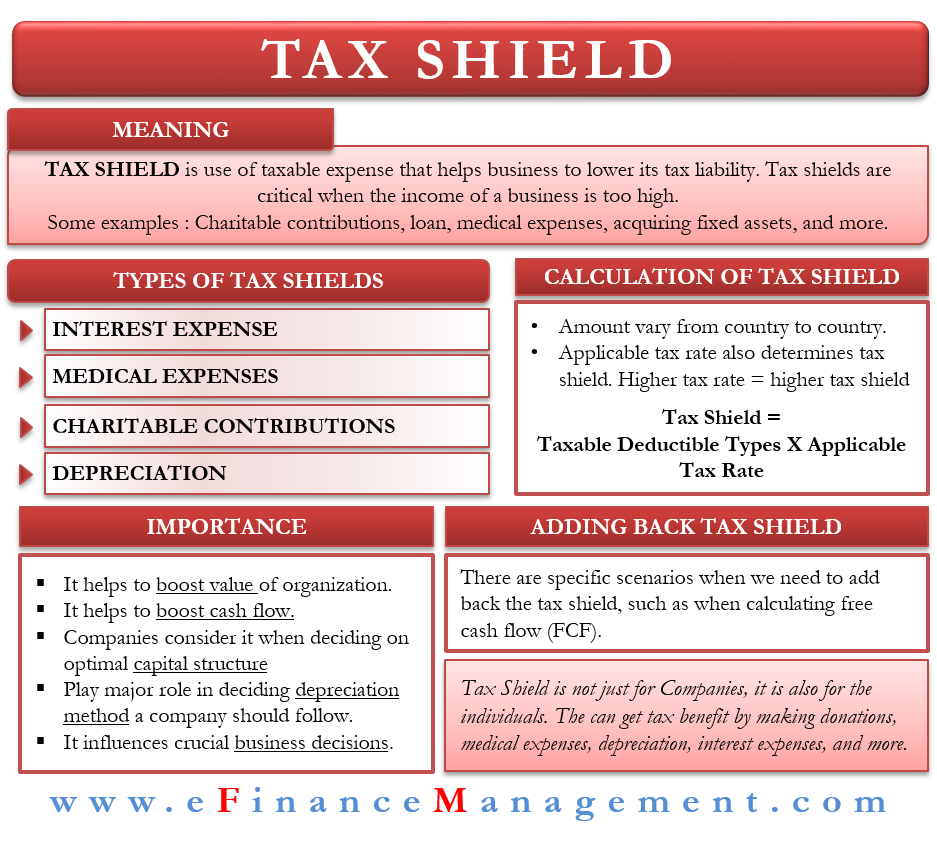

Even though the everybody uses the market value of debt rather than the book. Tax Shield Calculator This small business tool is used to find the tax rate by using interest expenses and depreciation expenses. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as.

Depreciation is considered a tax shield because depreciation expense. The tax shield formula is simple. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below Depreciation Tax Shield Sum of Depreciation expense Tax rate.

Tax Rate Tax Deductible Expenses1 Add Expenses. Depreciation tax shield calculator. 75000 The correct answer is a.

In general a tax shield is anything that reduces the taxable income for personal taxation or corporate taxation. What is the amount of the operating cash flow for a firm with. Depreciation Tax Shield Depreciation Expense X Tax Rate As you can see with this formula you can calculate how much you can shield yourself from taxes by leveraging.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is. Interest Tax Shield Definition The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Depreciation or CCA tax shield depreciation or CCA amount x.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Whatever Your Investing Goals Are We Have the Tools to Get You Started. This is equivalent to the 800000 interest expense multiplied by 35.

The intuition here is that the company has. There are a variety of deductions. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie.

After-tax benefit or cash inflow calculator. What is the amount of the annual depreciation tax shield for a firm. It gives you a chart showing expense of depreciation as usage and value.

Based on the information do the calculation of the tax shield enjoyed by the company. Lets imagine that the entire Business is worth 1000. The annuity depreciation calculator lets you do this calculation quickly.

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula How To Calculate Tax Shield With Example

Finan 3040 Chapter 9 Flashcards Quizlet

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Calculator Efinancemanagement

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Calculator Excel Template

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example